Wealth Management

We create customized investment strategies to help protect and grow your assets. We optimize investment choices to support those strategies, and then conduct ongoing scheduled reviews to update you and evaluate your strategies.Your client portal will give you a well-designed integrated view of your entire portfolio. And we will always be available to answer your questions and work with you to respond to changing circumstances.

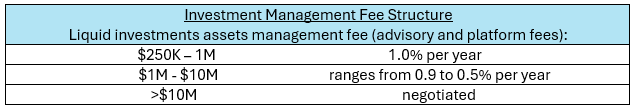

For those who are ready for personalized advisory services designed to help protect and efficiently manage savings and other assets, the Retirement Income Specialists team offers highly individualized investment allocation and asset management services. After our team creates your personalized financial plan, you have the option to use our wealth management. Depending on the size and complexity of your portfolio, you can expect to meet with our team 1-2 times per year to discuss your investments.

Services include:

- Manager and security selection

- Tax loss harvesting

- Ongoing due diligence for portfolio managers, risk mitigation, and expense management

- Portfolio rebalancing

- Cash flow management

- Facilitation of required minimum distributions

- Facilitation of Qualified Charitable Contributions

- Roth Conversion Strategies & Implementation

- Tax-sensitive and socially responsible investment strategies

- Coordination with your CPA to ensure careful tax planning

- Coordination with your estate planning attorney to ensure optimal charitable giving